Introduction

Welcome to our comprehensive review of Klarna in 2023. In this post, we will provide you with a complete overview of Klarna, a leading player in the e-commerce industry. From its inception to its current standing, we will delve into the importance of Klarna, the purpose of this review, and everything you need to know about this innovative payment solution.

1.1 Overview of Klarna

Klarna is a Swedish fintech company that was founded in 2005. It offers a range of payment solutions and services to both online and brick-and-mortar retailers, making it easier for customers to complete their purchases. With a mission to provide “smoooth” and hassle-free transactions, it has gained significant popularity and a strong presence in the e-commerce landscape.

1.2 Importance of Klarna in E-commerce

In today’s digital age, e-commerce has become an integral part of the global economy. As more consumers turn to online shopping, businesses need reliable and efficient payment solutions to enhance the customer experience and drive sales. Klarna has emerged as a key player in the e-commerce industry by offering flexible payment options and a streamlined checkout process, empowering both merchants and consumers alike.

1.3 Purpose of the Review

The purpose of this review is to provide you with an in-depth understanding of Klarna and its impact on the e-commerce ecosystem. We will explore its history, features, benefits, partnerships, customer support, competitive landscape, future prospects, and more. By the end of this comprehensive overview, you will have a clear picture of its capabilities and how it can benefit your business or enhance your online shopping experience.

Stay tuned for the next section, where we will delve into the intriguing history of Klarna and its journey from a small startup to a global payment solution.

Klarna: A Brief History

2.1 Founding and Early Years

Klarna was founded in 2005 by Sebastian Siemiatkowski, Niklas Adalberth, and Victor Jacobsson. The company’s vision was to simplify the online shopping experience by providing a seamless and secure payment solution. Initially, it operated as an online invoicing company, allowing customers to make purchases and pay for them later. This unique concept quickly gained traction, leading to Klarna’s rapid growth and expansion.

2.2 Growth and Expansion

As Klarna gained popularity in Sweden, it expanded its services to other European countries, including Norway, Finland, Denmark, and the United Kingdom. The company’s success can be attributed to its innovative approach and commitment to customer convenience. Its expansion continued, and by 2015, it had entered the United States market, marking a significant milestone in its global journey.

2.3 Key Milestones

Over the years, Klarna achieved several key milestones that solidified its position as a leading payment solution provider. In 2014, the company introduced its “Buy Now, Pay Later” feature, allowing customers to make purchases and pay for them in installments. This feature revolutionized the e-commerce industry, providing customers with greater flexibility and boosting conversion rates for merchants.

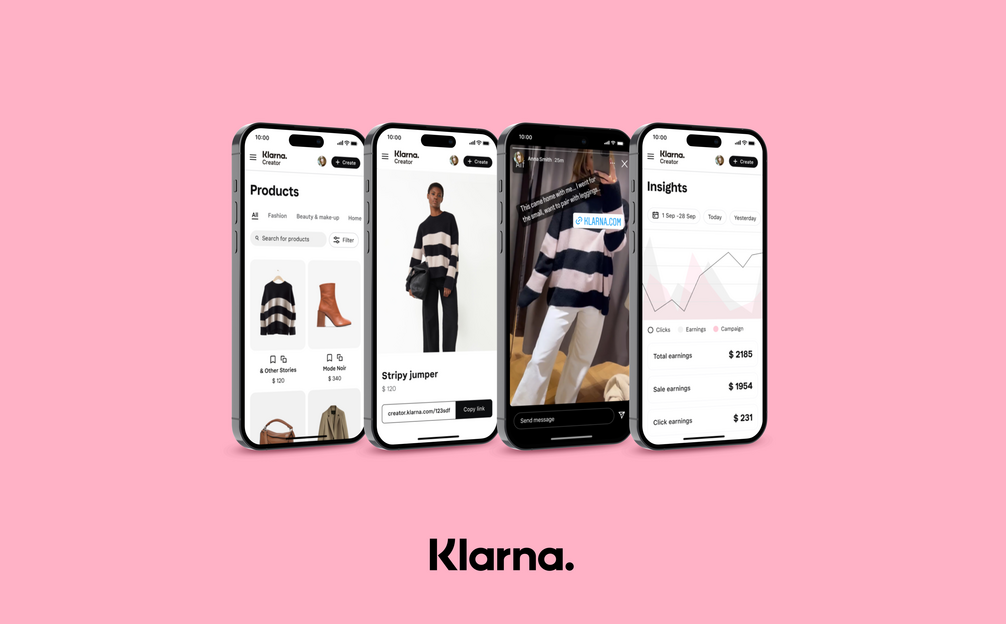

In 2017, Klarna launched its own app, enabling users to manage their payments, track purchases, and discover new retailers. The app’s intuitive interface and user-friendly features further enhanced the overall customer experience.

Furthermore, it expanded its services beyond online payments by introducing Klarna Checkout, a one-click purchasing solution. This streamlined checkout process eliminated the need for customers to enter their payment and shipping details repeatedly, making online shopping faster and more convenient.

As we delve deeper into this review, we will explore Klarna’s payment options, checkout process, integration with e-commerce platforms, and much more. Stay tuned to uncover the workings and benefits of Klarna’s innovative payment solutions.

How Klarna Works

3.1 Klarna’s Payment Options

Klarna offers a range of payment options designed to cater to the diverse needs of customers. One of the standout features is the “Pay Later” option, which allows shoppers to make purchases without immediate payment. Customers can receive their products and pay for them later, either in full or through installment plans, offering flexibility and convenience.

Additionally, it provides interest-free payments, enabling customers to split their purchase into equal installments at no extra cost. This feature has gained popularity among consumers who prefer to manage their expenses over time.

3.2 Klarna Checkout Process

Klarna’s checkout process is designed to optimize conversion rates and provide a seamless experience for customers. With Klarna Checkout, users can complete their purchases with just a few clicks, eliminating the need for manual data entry.

Customers can select Klarna as their payment option and enter minimal information, such as their email address and zip code. Klarna then performs a quick and secure credit assessment to provide an instant decision on the payment method.

The simplified checkout process reduces friction and improves the overall user experience, leading to higher conversion rates for merchants and a smoother shopping journey for customers.

3.3 Integration with E-commerce Platforms

Klarna has established partnerships and integrations with popular e-commerce platforms, making it easier for merchants to incorporate Klarna’s payment solutions into their websites or online stores. Through these integrations, businesses can offer Klarna’s payment options seamlessly, providing customers with a convenient and familiar payment experience.

The integration process is typically straightforward, requiring minimal technical knowledge. Merchants can access Klarna’s developer resources and documentation to integrate the payment solutions into their platforms efficiently. This integration empowers businesses to leverage Klarna’s capabilities and tap into its extensive customer base.

As we continue our exploration of Klarna, we will uncover the features and benefits that make it a preferred choice for both customers and merchants. Stay tuned to learn about the advantages of interest-free payments, the buy now, pay later option, and the enhanced checkout experience Klarna offers.

Features and Benefits of Klarna

4.1 Interest-Free Payments

One of the key features that sets Klarna apart is its interest-free payment options. Customers can split their purchases into equal installments without incurring any interest charges. This feature provides financial flexibility, allowing shoppers to manage their budgets effectively while enjoying the products they desire. By offering interest-free payments, Klarna enhances the affordability of purchases, making it an attractive payment solution for customers.

4.2 Buy Now, Pay Later Option

Klarna’s “Buy Now, Pay Later” option has transformed the way customers approach online shopping. With this feature, shoppers can receive their products immediately and delay the payment. Whether it’s a fashion item, home decor, or electronics, customers can enjoy their purchases before making the payment in full or in installments. This convenient option empowers consumers to make informed buying decisions without worrying about immediate financial obligations.

4.3 Smooth Checkout Experience

Klarna’s commitment to a smooth and seamless checkout experience benefits both customers and merchants. The streamlined checkout process eliminates unnecessary steps and minimizes the time and effort required to complete a purchase. With fewer barriers to entry, customers are more likely to finalize their transactions, boosting conversion rates for merchants. Klarna’s user-friendly interface and intuitive design contribute to an enjoyable and hassle-free checkout experience.

4.4 Increased Conversion Rates

By integrating Klarna’s payment solutions, merchants can experience a significant boost in conversion rates. The availability of flexible payment options and the convenience of deferred payments attract customers who may have otherwise abandoned their carts due to financial constraints. With Klarna, merchants can tap into a larger customer base, improve their sales figures, and enhance their overall profitability.

4.5 Consumer Protection and Security

Klarna prioritizes consumer protection and security throughout its operations. With robust encryption and advanced security measures, Klarna ensures that sensitive customer information remains confidential and protected. Customers can have peace of mind knowing that their personal and financial data is safeguarded during transactions. This focus on security contributes to building trust and confidence among customers, further solidifying Klarna’s reputation as a reliable payment solution.

As we continue our comprehensive overview of Klarna, we will explore its partnerships, integration with e-commerce platforms, customer support, competitive landscape, and future prospects. Stay tuned to discover how Klarna has established itself as a leader in the payment industry, providing innovative solutions that benefit both businesses and consumers.

4.6 Pricing and Fees for Businesses

Klarna offers businesses a competitive pricing and fee structure that aligns with their specific needs and helps drive their e-commerce success.

The exact pricing and fees for businesses using Klarna’s payment solutions may vary based on factors such as the size of the business, transaction volume, industry, and geographical location. Klarna provides customized pricing plans tailored to meet the unique requirements of different businesses, ensuring that they receive a cost-effective solution that fits their budget.

The fees charged by Klarna typically include transaction fees based on the value of each purchase made using Klarna’s payment options. These fees are generally a percentage of the transaction amount, and they may vary depending on the specific payment option chosen by the customer. Klarna’s sales representatives can provide businesses with detailed information regarding the applicable fees and help them understand how they align with their sales volume and revenue.

For all payment plans, Klarna typically charges merchants a $0.30 transaction fee, as well as variable fees between 3.29% and 5.99% of the transaction total. Though, merchants may assume they’ll make up for these costs via their increased volume of sales.

Klarna’s Partnership and Integration

5.1 Partnerships with Retailers

Klarna has formed strategic partnerships with a wide range of retailers, spanning various industries. These partnerships enable Klarna to offer its payment solutions to a diverse customer base, ranging from small businesses to global brands. By collaborating with retailers, Klarna expands its reach and enhances its value proposition by providing seamless payment options to a vast array of customers. This network of partnerships solidifies Klarna’s position as a trusted and widely accepted payment solution.

5.2 Integration with Popular E-commerce Platforms

Klarna understands the importance of integration with popular e-commerce platforms to facilitate a smooth and efficient payment process. It has established integrations with major platforms such as Shopify, Magento, WooCommerce, and more. These integrations enable merchants to seamlessly incorporate Klarna’s payment solutions into their online stores, offering a convenient and familiar payment experience to their customers. By integrating with popular e-commerce platforms, Klarna provides accessibility and ease of use, benefiting both merchants and shoppers.

5.3 Case Studies and Success Stories

Klarna’s success is exemplified by numerous case studies and success stories from businesses that have benefited from its payment solutions. These case studies showcase the positive impact Klarna has had on businesses by increasing conversion rates, improving customer satisfaction, and driving sales. From startups to established brands, businesses have reported substantial growth and improved customer loyalty through their partnership with Klarna. These success stories highlight the value that Klarna brings to businesses and demonstrate its ability to support their growth and success.

As we near the conclusion of our comprehensive overview, we will delve into Klarna’s customer support and service, its competitive landscape, future prospects, and provide a recap of the key points covered throughout this review. Stay tuned to gain a complete understanding of Klarna in 2023 and its significance in the evolving e-commerce industry.

Klarna’s Customer Support and Service

6.1 Accessibility and Availability

Klarna is committed to providing accessible and reliable customer support. Whether merchants or shoppers encounter any issues or have inquiries regarding payments, Klarna ensures that assistance is readily available. The company offers multiple support channels and resources to cater to the needs of its users. This accessibility and availability of customer support contribute to a positive user experience and build trust in Klarna’s services.

6.2 Support Channels

Klarna provides various support channels to address customer queries and concerns. These channels may include email support, live chat, and phone support. Customers and merchants can reach out to Klarna’s support team through their preferred channel to receive prompt assistance. The support team is trained to provide knowledgeable and friendly support, resolving issues efficiently and effectively. Klarna’s commitment to responsive and helpful customer support sets it apart as a customer-centric payment solution.

6.3 User Satisfaction and Feedback

User satisfaction is a top priority for Klarna, and the company actively seeks feedback from its users. By listening to customer experiences and opinions, Klarna continuously improves its services and addresses any pain points. User feedback plays a crucial role in shaping Klarna’s offerings and ensures that the payment solutions align with the needs and expectations of its users. This dedication to user satisfaction fosters long-term relationships and customer loyalty.

In the final sections of our complete overview, we will explore Klarna’s competitive landscape, market position in 2023, its future prospects, and provide a comprehensive conclusion. Stay tuned to gain valuable insights into Klarna’s positioning within the payment industry and its potential for growth and innovation.

Klarna’s Competitive Landscape

7.1 Comparison with Other Payment Solutions

In the highly competitive payment solutions market, Klarna has established itself as a leading player with its unique offerings. When compared to traditional payment methods, such as credit cards or PayPal, Klarna stands out by providing flexible payment options, interest-free payments, and a streamlined checkout process. These features differentiate Klarna and make it an appealing choice for both customers and merchants.

7.2 Strengths and Weaknesses

Klarna’s strengths lie in its user-friendly payment solutions, seamless integration with e-commerce platforms, and strong partnerships with retailers. The company’s commitment to customer convenience, interest-free payments, and innovative features gives it a competitive edge.

However, Klarna does face some challenges. One of the main concerns is the potential risk of customers overspending or defaulting on payments, which can impact the financial stability of both customers and merchants. Klarna addresses these challenges through credit assessments and responsible lending practices. It continuously evaluates and refines its risk management processes to mitigate potential risks.

7.3 Market Position in 2023

As of 2023, Klarna has established a prominent position in the global payment solutions market. Its growth trajectory and expanding customer base have solidified its presence in key markets, including Europe and the United States. With a strong emphasis on innovation and customer-centric solutions, Klarna has become a trusted brand for online payments, consistently gaining market share and recognition.

Klarna’s Future Prospects

8.1 Emerging Trends and Opportunities

Looking ahead, Klarna is well-positioned to capitalize on emerging trends in the e-commerce and payment industry. The increasing popularity of online shopping, the rise of mobile commerce, and the demand for flexible payment options present significant opportunities for Klarna to expand its user base and market reach.

8.2 Predictions for Klarna in the Coming Years

It is anticipated that Klarna will continue to innovate and refine its payment solutions, introducing new features and expanding its partnerships. The company’s strong market presence and commitment to customer satisfaction position it favorably for sustained growth. Additionally, Klarna may explore opportunities in new markets and industries, further solidifying its position as a global leader in the payment solutions landscape.

8.3 Potential Challenges and Risks

While Klarna has achieved remarkable success, it is not immune to potential challenges and risks. Regulatory changes, increasing competition, and evolving consumer preferences are factors that Klarna must navigate effectively. Adapting to changing market dynamics and ensuring the ongoing trust and satisfaction of its users will be crucial for Klarna’s long-term success.

Conclusion

9.1 Recap of Key Points

In this complete overview of Klarna in 2023, we explored the company’s history, importance in e-commerce, payment options, checkout process, partnerships, customer support, competitive landscape, and future prospects. Klarna has emerged as a leader in the payment solutions industry, offering innovative and customer-centric services.

9.2 Final Thoughts on Klarna in 2023

As we conclude, it is evident that Klarna’s commitment to providing convenient, secure, and flexible payment options has revolutionized the e-commerce experience for both customers and merchants. With its interest-free payments, buy now, pay later option, streamlined checkout process, and extensive partnerships, Klarna has positioned itself at the forefront of the payment solutions market.

As the e-commerce landscape continues to evolve, Klarna is well-prepared to meet the changing needs and preferences of customers. By embracing emerging trends, refining its services, and navigating potential challenges, Klarna is poised for continued growth and success in the years to come.

Related Posts

For more information on 2Checkout, another popular payment processing solution, check out the post titled “2Checkout is Now Verifone Review in 2023: A Complete Overview”.